Table of Content

The Customer/Guardian/Parent understands and agrees that ICICI Bank retains the right to freeze operation of the Young Stars Account, if the cumulative value of the total debits in the account in a financial year exceeds the Total Debit Limit, as applicable to the particular Young Stars Account. For all details on the eligibility, features, rates and charges and general information on this account variant, please refer to the Website for more information. Any notice from ICICI Bank in respect of the Young Stars Account/Debit Card may be given by ICICI Bank by delivering it to the Guardian/parent personally or by posting it to the latest address recorded with ICICI Bank. Any transaction done / instruction provided / information given by the User / Guardian / parent with respect to the Account through ICICI Bank's internet banking whether the same is done directly from the ICICI Bank internet banking login id of the User or by virtue of it being linked with the Guardian's / parent's ICICI Bank internet banking login id. ICICI Bank reserves the right to close or freeze the Account, or terminate the banking relationship with a Customer, after due notice to the Customers at the Customer’s last know/updated address without assigning any reason therefor and without any liability.

The continuance of the Young Stars Debit Card issued to the Young Stars Cardholder, being a special facility issued at the request of the Guardian/parent, will be solely dependent on the continuation of the Young Stars Account. The login id and password will be issued by ICICI Bank to the User who is the Guardian/parent himself, on the specific understanding that all amounts paid to or to the order of the User on the basis of the said login id and password and all commission/fees, interest, costs, charges, expenses in relation thereto shall be debited to the Account. Customer agrees and confirms that he/she wishes to invest in Mutual Funds (“MF”) and in this regard, consents to share their account details and other KYC details with Securities and Exchange Board of India, Know Your Client Registration Agencies, other entities as may be required for enabling registration/verification for MF investments. Customer further authorizes the Bank and its representatives to contact them in relation to MF investments. The Direct Benefit Transfer (“DBT)” linked Account of the Customer shall be used for receiving Government payment across schemes under Section 7 of the Aadhaar Act, 2016 that they are eligible for and/or any other payment using the Aadhaar based information.

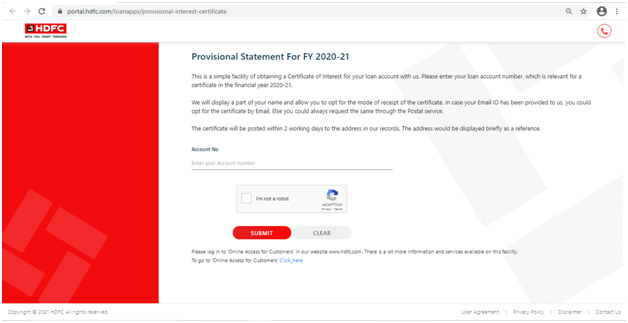

How to check HDFC Bank loan statement through the registered email ID?

Charges will be debited from the Account at such intervals as may be deemed fit by ICICI Bank. Transactions are entertained during banking hours at the branch where the Account is maintained or at any other ICICI Bank branches under Any Where Banking . ICICI Bank shall not be liable for any delay on any account of failure of connectivity. AWB will not be available on the day when the branch where the Account holder has his/her relationship, is closed. The obligations with respect to the Account and operations of the Account are subject to all applicable Laws . The Customer understands and confirms that the Bank will be entitled at all times, to act in accordance with applicable Laws, without requiring to provide prior intimation of such actions to the Customer.

DeFi is huge in the banking sector as it aims to remove the middleman in the banking transactions and create complete transparency. The students will be creating smart contracts for implementing key features of lending and borrowing and deploying it on a test network. Students will also understand how to measure the performance of the application.

KOTAK MAHINDRA BANKPersonal Loan

Metro AG global chief executive officer Steffen Greubel said the company is at a “very advanced” level of discussions on its India business, suggesting for the first time that it could be looking at an exit from the country soon. Tata Consultancy Services is well on its path to double its revenues to $50 billion by 2030, but in 2023 India’s largest software services firm foresees an impact of a combination of the interest rate tightening by the US Federal Reserve and a volatile geopolitical scenario, said its CEO &MD Rajesh Gopinathan. You can call ourCustomer Care, authenticate yourself and choose the ‘Self Banking’ option to get your User ID. Once you have your User ID, pleaseclick hereto generate your password instantly online. Loginwith your User ID and Password to view and download your Credit Card statement.

If you are looking for credit, we will make sure you find it, and ensure that it is the best possible match for you. We get your Credit Score online and provide a free Credit Health Analysis of your Equifax report. Based on the analysis, we help you discover loans and credit cards best suited for your credit profile. We help you understand your Credit Profile, Credit Information Report and know where you stand. We make it easy for you to browse through and compare the various financial products on offer on the market; access our free and user-friendly online tools; and finally, enjoy a stress-free application process with quick approvals.

Verge Deals

The Customer shall be responsible for maintaining a Monthly Average Balance (“MAB”) during a month. Failure to maintain the prescribed MAB may attract charges and such charges may be deducted by ICICI Bank from the Customer’s Account. The Customer agrees that for each account variant and product feature offered, MAB requirements might vary and the Customer agrees that he/she/they have read and understood the respective MAB requirements to be maintained and the default charges in respect of non-maintenance of the MAB in the respective product variant. For all details on the MAB requirement, the Customer may refer the Schedule of charges/Tariff Guide or the Website.

The issue of the login id and password is subject to there being adequate credit balance in the Account (in accordance with ICICI Bank’s applicable rules). Any cheques issued by Guardian/parent prior to the date of the Customer attaining majority and which has been presented for clearing after the conversion of the Young Stars Account shall not be honoured by ICICI Bank. Upon the Customer attaining majority, the Guardian/parents shall not be permitted to operate the Young Star Account. In the event the Customer wishes to revoke the POA, he shall be required to give a notice of revocation of the POA to ICICI Bank in writing.

Download ET App:

ICICI Bank shall be entitled to refuse authorization for any withdrawal/purchase/expenses in excess of the daily limits or in the event of ICICI Bank being under a reasonable apprehension that a fraud is sought to be perpetrated, or there being circumstances, which in the reasonable opinion of ICICI Bank, merit that authorization should be refused. For all details on the eligibility, features, rates and charges and general information on this account variant, please refer to the specific product page on the Website. ICICI Bank shall not be liable for any failure to perform any obligation contained in these POA holder terms and conditions or for any loss or damage whatsoever suffered or incurred by the POA holder howsoever caused and whether such loss or damage is attributable to any dispute or any other matter or circumstances whatsoever. ICICI Bank shall not be responsible for ensuring that the POA holder operates the Account for the purposes mentioned in the POA or for monitoring the transactions carried out by the POA holder in any manner whatsoever. Any dispute regarding the operation of the Account by the POA holder shall be settled by the Customer directly with the POA holder without any reference to ICICI Bank.

Please note with effect from May 1, 2013 all Savings Account customers availing Alerts facility through an SMS will be charged Rs. 15 per quarter. Ujjwal Mathur, Country Head, TCS India, said, "This is a landmark moment in our partnership with ICICI Bank as we help them digitally transform the retail lending process and experience using the TCS lending platform. This further reinforces the bank`s reputation for using digital technologies to provide superior customer experiences and drive competitive differentiation." TCS in the statement said its open API architecture enables the back-office processing to be seamlessly integrated with third parties such as legal counsel and property evaluators to accelerate the workflows and eliminate paperwork. Top-up Loan allows customers to avail of a certain amount of money, over and above the existing Home Loan.

UpGrad will not charge any processing fees or down payment for these transactions, this will be purely between you and your bank. Yes you can check your HDFC Bank personal loan status offline by visiting the nearest HDFC Bank branch. It is advised to carry the relevant documents related to your personal loan account, such as HDFC loan agreement number, etc. so that the bank can check the status instantly without any hassle.

With this service, you will receive an SMS on your registered mobile number informing you about your latest banking transactions like credit or debit, cheque return etc in your savings account. Yes, you can easily apply for a new loan using HDFC Bank online/netbanking portal. All you need to do is login to the net banking portal and click on the “Loans” tab given on the top menu. Now you can either fill a personal loan application online or even ask the HDFC Bank to have its representatives call you back with personal loan offers available for you.

In general, it can take up to 30 days for your application to be processed and approved/rejected. After completing the application process, you can track the application process using the methods given above. I was skeptical at first, since it is generally not easy to get things done online in India. To my surprise, the entire home loan process was very quick and I had constant support and help from my relationship manager. There was no over-promising of any sorts and he cleared all my doubts with patience.

The Customer is/are expected to examine the entries in the Account statement/passbook on receipt, and draw the attention of ICICI Bank to any errors or omissions that might be discovered. ICICI Bank does not accept any responsibility for any loss arising out of failure on the part of the Customer to carry out examination of entries in the passbook/Account statement and to point out such error and/or omission within fourteen days from the date of the Account statement/updation of passbook. In case of joint Accounts, any change in operational instructions with regard to the Account Opening Form would have to be given by all the joint Account holders irrespective of the mode of operation. The Customer agree and confirm that the GST Identification Number (“GSTIN”) provided at the time of Account opening will be the default/ primary in case of multiple GSTIN and will be used for charging GST and reporting on the GST Network (“GSTN”) portal, unless otherwise specifically requested by the Customer with respect to any transaction. The Customer agree and confirm that the details furnished at the time of Account opening are true and correct to the best of his/her/their knowledge and belief, and he/she/they undertake to inform ICICI Bank of any changes, immediately.

No comments:

Post a Comment